Count On Credifin for Comprehensive Debt Collection Solutions

Wiki Article

Reliable Approaches for Lending Collection: Recover Your Financial debts

You will certainly find out just how to comprehend financial obligation recovery techniques, construct far better interaction with debtors, carry out a structured collection procedure, utilize technology for effective debt management, and also browse legal factors to consider. With these actionable ideas, you can take control of your finance collection procedure as well as effectively recuperate your financial obligations.

Understanding Debt Healing Methods

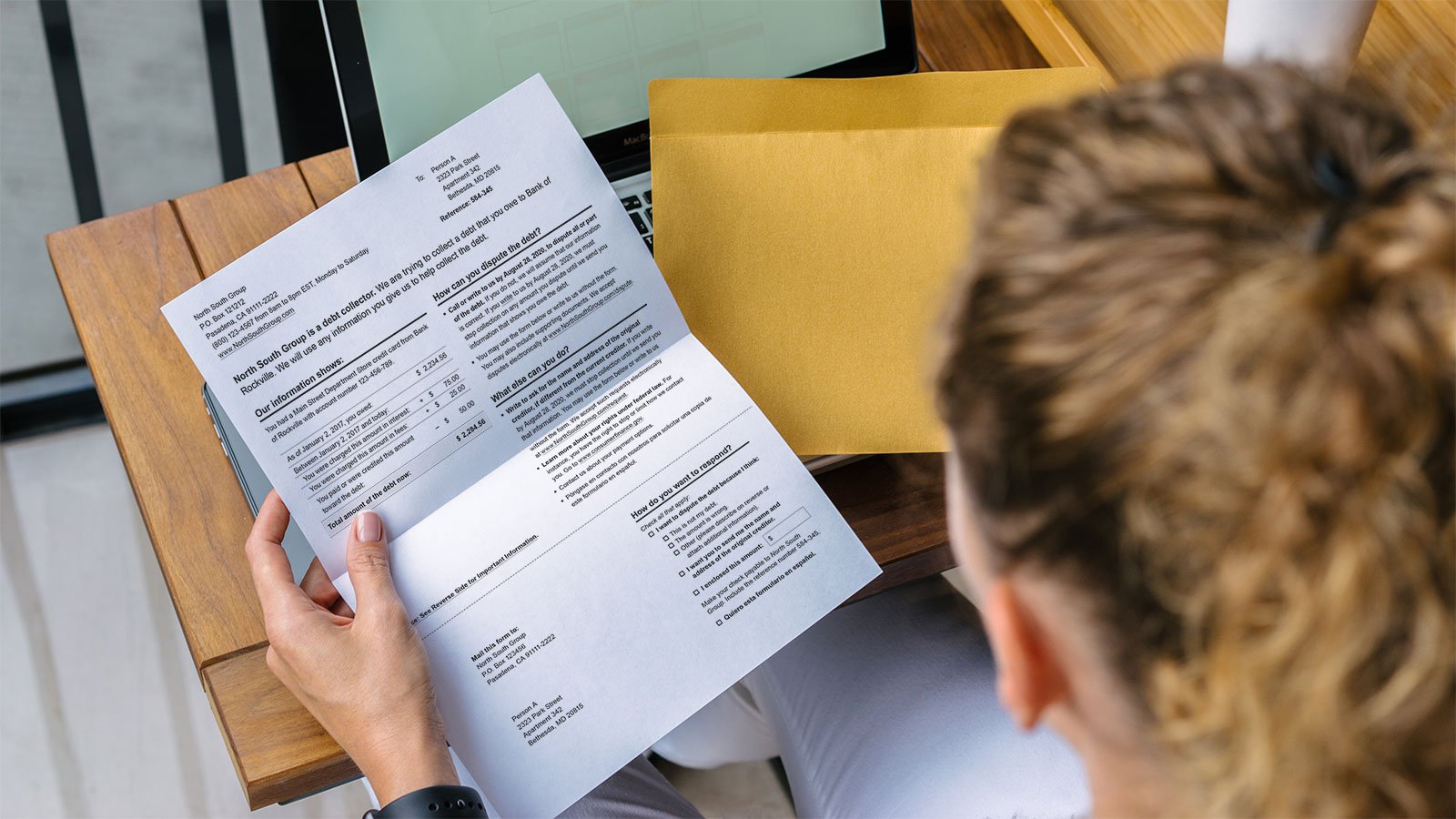

To effectively recuperate your financial debts, you require to comprehend financial debt recovery strategies. One vital technique is communication.An additional efficient financial debt recuperation technique is paperwork. Maintaining thorough records of all interactions, arrangements, and also repayment history is vital. This documentation can offer as proof in instance lawsuit ends up being necessary. Furthermore, it aids you stay organized and track the progression of your debt collection efforts.

Using the services of a debt collection agency can significantly improve your possibilities of successful financial debt recuperation. These agencies have the competence and sources to manage the collection process on your part. They utilize numerous techniques, such as miss tracing and also debt reporting, to situate debtors as well as encourage timely settlement.

Building Reliable Communication With Debtors

Start by getting to out to your consumers in a professional and friendly way. Allow them understand that you know their superior debt and that you want to deal with them to find a service. Show empathy as well as understanding towards their scenario, yet likewise make it clear that you expect the financial obligation to be paid back.

During your conversations, be certain to proactively pay attention to what your consumers need to state. Ask open-ended inquiries to encourage them to share their obstacles as well as issues - credifin. This will aid you acquire a much better understanding of their financial situation and also allow you to come up with an ideal settlement strategy

Preserve regular call with your debtors throughout the financial obligation healing process. This will certainly assist them feel sustained and also will certainly also work as a reminder of their commitment to pay back the debt. By remaining in touch, you can attend to any type of issues or problems that may arise and also keep the lines of communication open.

Implementing a Structured Collection Process

By implementing an organized collection process, you can streamline the financial debt healing process and also enhance your opportunities of returning what is owed to you. Having a structured technique implies having a clear strategy in position to handle debt collection. This includes establishing details steps and treatments to follow when managing customers that have exceptional financial debts.To start with, it is essential to develop a timeline for debt collection. This timeline ought to lay out the particular activities that require to be taken at various phases of the process, such as sending tips, issuing warnings, or perhaps taking legal activity if necessary. By having a clear timeline, you can guarantee that you are continually and proactively pursuing the healing of the financial debt.

Secondly, implementing a structured collection process indicates having an organized method to documents and also record-keeping. This consists of keeping exact documents of all interactions with borrowers, in addition to any kind of arrangements or guarantees made concerning settlement. If lawful action comes to be necessary, having these documents readily offered can aid you track the progression of each case and also offer proof.

Finally, a structured collection procedure includes routine tracking and analysis. This implies consistently examining as well as analyzing the performance of your collection initiatives. By determining any areas of enhancement or patterns in consumer behavior, you can make needed changes to your techniques as well as boost your possibilities of successful debt recuperation.

Using Modern Technology for Effective Financial Debt Administration

Making use of modern technology can considerably enhance the performance of managing your financial debt. With the improvements in technology, there are now a myriad of tools and sources available to assist you simplify your financial obligation management process. One of one of the most effective methods to make use of innovation is by utilizing debt administration software program. This software enables you to track your financial debts, create repayment routines, and set tips for upcoming settlements. By having all of this information in one location, you can quickly remain arranged and guarantee check these guys out that you never ever miss out on a settlement. Additionally, modern technology can also help you automate your payments. Lots of financial institutions and also loan providers currently provide on-line platforms where you can set up automatic payments, getting rid of the requirement for hands-on treatment. This not just conserves you effort and time yet additionally lowers the threat of late payments and associated fees. Additionally, innovation can likewise provide you with accessibility navigate to this site to valuable sources such as budgeting tools as well as financial calculators. These devices can assist you track your costs, produce a budget, and calculate the most effective settlement approach for your details situation. On the whole, by leveraging modern technology, you can properly handle your financial obligation and improve your economic wellness.Lawful Considerations in Financing Collection

When it comes to recuperating your financial obligations, it is essential to understand the lawful elements included. It's likewise important to acquaint on your own with the Fair Financial Obligation Collection Practices Act (FDCPA), which sets standards on exactly how financial obligation collectors can connect with consumers. By comprehending as well as following the lawful factors to consider in lending collection, you can make certain that you are running within the limits of the law while optimizing your possibilities of recovering the financial debts owed to you.Conclusion

To conclude, by applying efficient strategies for financing collection, you can effectively recover your financial debts. Building solid communication with consumers as well as applying a structured collection procedure are key. Using technology can likewise greatly improve debt administration efficiency. Nonetheless, it is essential to be knowledgeable about legal considerations when collecting car loans (credifin). By following these methods, you can increase your possibilities of effectively recovering the debts owed to you.You will discover just how to understand debt recuperation methods, develop far better interaction with consumers, execute an organized collection procedure, use modern technology for effective financial obligation management, and navigate legal considerations. To efficiently recover your debts, you need to comprehend financial obligation healing methods. Using the important source services of a financial obligation collection agency can greatly improve your chances of effective financial debt recuperation. It's likewise essential to familiarize on your own with the Fair Debt Collection Practices Act (FDCPA), which establishes standards on exactly how financial obligation collectors can interact with borrowers. By understanding and also adhering to the legal considerations in lending collection, you can ensure that you are running within the borders of the law while maximizing your chances of recouping the financial obligations owed to you.

Report this wiki page